1265 Tax advisor found with tax advice: Real Estate / Rental (from 13702)

1265 Tax advisor found with tax advice: Real Estate / Rental (from 13702)

-

Standard Sortierung erklärt

Die Sortierung erfolgt nach der Anzahl von Punkten, die ein Tax advisor-Eintrag gesammelt hat (0 bis 400 Punkte).

Punkte erhält ein Eintrag für Vollständigkeit (ausgefüllte Eigenschaften und Bilder), Bewertungen und Premium.

In Kombination mit der Freitextsuche zeigen wir vorrangig zum Suchbegriff passende Tax advisor.

-

Distance from the center of the area

For towns, districts and postcode areas, the results can be sorted here by distance from the center.

-

25474 Ellerbek, Schleswig-Holstein, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list20Data is loading...

-

56154 Boppard, Rhineland-Palatinate, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list20Data is loading...

-

59065 Hamm, North Rhine-Westphalia, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list20Data is loading...

-

66265 Heusweiler, Saarland, Germany

industries:Doctors Gastronomy / Hotel / TourismDoctorsGastronomy / Hotel / TourismFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list20Data is loading...

-

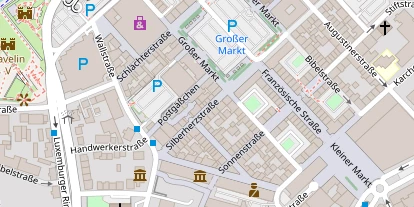

66740 Saarlouis, Saarland, Germany

industriesindustries: not specifiedFor whom:Cross-border commutersCross-border commutersadded to favorites list

Show favorites listremoved from favorites list

Show favorites list20Data is loading...

-

67549 Worms, Rhineland-Palatinate, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list20Data is loading...

-

71364 Winnenden, Baden-Württemberg, Germany

industries:Gastronomy / Hotel / TourismGastronomy / Hotel / TourismFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list20Data is loading...

-

80538 München, Bavaria, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list20Data is loading...

-

85560 Ebersberg, Bavaria, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list20Data is loading...

-

70563 Stuttgart, Baden-Württemberg, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list18Data is loading...

-

90556 Cadolzburg, Bavaria, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list18Data is loading...

-

17033 Neubrandenburg, Mecklenburg-Western Pomerania, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list18Data is loading...

-

22848 Norderstedt, Schleswig-Holstein, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list18Data is loading...

-

26123 Oldenburg, Lower Saxony, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list18Data is loading...

-

46395 Bocholt, North Rhine-Westphalia, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list18Data is loading...

-

53819 Neunkirchen-Seelscheid, North Rhine-Westphalia, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list18Data is loading...

-

61348 Bad Homburg vor der Höhe, Hesse, Germany

industriesindustries: not specifiedFor whomFor whom: not specifiedadded to favorites list

Show favorites listremoved from favorites list

Show favorites list18Data is loading...

Tax advice on real estate acquisition and ownership Buying houses and apartments is not only a goal for many young people to use as their own home; real estate also appears attractive as an investment with a long-term investment horizon. In addition to taxes that can be incurred when buying and selling, most tax questions relating to real estate arise in the tax return, in which not only rental income must be declared, but also expenses for the maintenance and modernization of the property can reduce your tax burden as depreciation. Professional tax advice can be financially worthwhile here. But you can also have your tax advisor check the profitability when setting up financing for a purchase on credit.

Where can a real estate tax advisor be helpful?

Regardless of whether you want to buy a condominium, have inherited a house or want to invest your money profitably in real estate: the sums of money that are tied up in these properties and flow back and forth when buying and selling are large; there is also regular income from rent and maintenance costs. These large amounts quickly make it worthwhile to go to a tax advisor, as they can find and optimize savings potential in many areas.

Tax advice on real estate planning

Even before you buy a house or a condominium, it can be worthwhile to contact a tax advisor. Many people see real estate as a worthwhile long-term investment: the material value is subject to only minor fluctuations over time and, especially in metropolitan areas, the expected rental income increases from year to year. The leverage effect of using borrowed capital also makes real estate interesting for investors: in the current low-interest environment, taking out a loan to finance apartments and houses is particularly attractive. You can also discuss with your tax advisor how the long-term return on real estate compares to stocks or other bank products, taking bank loans and taxes into account. Especially if the tax advisor specializes in real estate law, he or she can better assess the risks and profit opportunities of these investments. But even apart from the idea of buying residential property as a profitable investment, many people dream of owning their own home to live in themselves. For most people, however, this also means taking out a loan to be able to pay the property price and all incidental costs. You can also get advice on such financing and have it checked at tax offices.

How can you save taxes on property maintenance?

Even if owning a residential house or commercial building is often referred to as concrete gold, larger investments are required from time to time to maintain or increase the value of real estate: in old buildings, insulation measures for walls and roofs are necessary; replacing windows, the heating system or sanitary facilities is also rare, but costs a lot. Fortunately, a large part of the costs for tradesmen and maintenance costs can be deducted from taxes. A tax advisor who specializes in real estate can best explain to you how you can save the most taxes by deducting expenses for your house from your taxes. Since the costs involved can be very high, professional support is particularly worthwhile here.

What taxes apply to real estate?

If you want to look at condominiums and houses from a tax perspective, there are essentially five taxes to consider: real estate transfer tax must be paid when buying, and speculation and inheritance taxes are due when selling or bequeathing real estate. Property tax, on the other hand, must be paid every year and is based on the valuation of the respective property. However, the most extensive impact a property will have on your tax situation is on your income tax. Not only potential rental income must be taken into account here; your tax burden can also be reduced through depreciation; and if you use the property yourself, you can claim some expenses as retirement provisions. Because detailed knowledge of the legal situation and tax law is essential to keep the tax burden low, it is worthwhile for homeowners and real estate investors to seek tax advice from specialized tax firms.

Interesting Tax advisor

Premium Tax advisor are displayed here.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

.png?h=64&w=200&mode=max&scale=canvas&format=webp&autorotate=true)

.png)