2139 Tax advisor found with financial and payroll accounting: VAT advance returns (from 13701)

2139 Tax advisor found with financial and payroll accounting: VAT advance returns (from 13701)

-

Standard Sortierung erklärt

Die Sortierung erfolgt nach der Anzahl von Punkten, die ein Tax advisor-Eintrag gesammelt hat (0 bis 400 Punkte).

Punkte erhält ein Eintrag für Vollständigkeit (ausgefüllte Eigenschaften und Bilder), Bewertungen und Premium.

In Kombination mit der Freitextsuche zeigen wir vorrangig zum Suchbegriff passende Tax advisor.

-

Distance from the center of the area

For towns, districts and postcode areas, the results can be sorted here by distance from the center.

-

35274 Kirchhain

industries:pharmacist Doctors eCommercepharmacistDoctorseCommerceGardening and landscapingGastronomy / Hotel / TourismCraftsProperty managementHealthcare / Nursing / HealthindustryEngineers / Technical ProfessionsIT / MultimediaArtists / MusiciansAgriculture / ForestryMedia / MarketingPublic service / civil servantsPilots / Flight AttendantsLawyers / NotariesStudentsPetrol stationsVeterinariansTravel agency / agentTransport / Freight forwarding / Taxi companyDentistsFor whom:Small business / GbR / OHG / KG / PersG Ltd. FreelancerSmall business / GbR / OHG / KG / PersGLtd.FreelancerSelf-employedEntrepreneursEmployeesPensionersCross-border commutersAssociations / Foundationsadded to favorites list

Show favorites listremoved from favorites list

Show favorites list25Data is loading...

-

30659 Hannover, Lower Saxony, Germany

industriesindustries: not specifiedFor whom:Small business / GbR / OHG / KG / PersG Ltd. FreelancerSmall business / GbR / OHG / KG / PersGLtd.FreelancerSelf-employedEmployeesPensionersAssociations / Foundationsadded to favorites list

Show favorites listremoved from favorites list

Show favorites list23Data is loading...

-

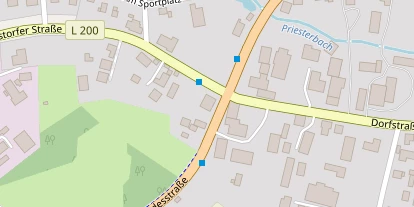

23881 Breitenfelde

industries:pharmacist Doctors Gardening and landscapingpharmacistDoctorsGardening and landscapingCraftsProperty managementHealthcare / Nursing / HealthindustryEngineers / Technical ProfessionsIT / MultimediaArtists / MusiciansMedia / MarketingPublic service / civil servantsLawyers / NotariesVeterinariansTravel agency / agentDentistsFor whom:Small business / GbR / OHG / KG / PersG Freelancer Self-employedSmall business / GbR / OHG / KG / PersGFreelancerSelf-employedEmployeesPensionersadded to favorites list

Show favorites listremoved from favorites list

Show favorites list22Data is loading...

advance VAT return

All companies must submit regular advance VAT returns to their tax office. The VAT collected (from sales) and the deductible input tax (from purchases and services) must be compared.

Here are the most important points to consider:

- Depending on the size and turnover of the company, the advance declaration must be made monthly,

The advance declaration must be submitted quarterly or annually. The advance declaration must be submitted by the 10th day of the following month , unless there is an extension for the tax advisor.

The advance declaration must be submitted quarterly or annually. The advance declaration must be submitted by the 10th day of the following month , unless there is an extension for the tax advisor. - To ensure that the tax office receives a regular and timely overview of VAT payments , it must receive the company’s pre-registration on time.

- The difference between the sales tax collected and the input tax paid is used to determine whether the company has to pay money to the tax office or whether it will receive a refund .

- Depending on the size and turnover of the company, the advance declaration must be made monthly,

By regularly calculating the VAT return , the company avoids having to pay a large sum of taxes all at once at the end of the year.

Interesting Tax advisor

Premium Tax advisor are displayed here.

-

Dipl.-Kfm. Michael Schröder Steuerberater

Berlin

Dipl.-Kfm. Michael Schröder Steuerberater

Berlin

-

Herr Steuerberatungsgesellschaft mbH

Freiburg im Breisgau

Herr Steuerberatungsgesellschaft mbH

Freiburg im Breisgau

-

Oetje + Schierenbeck Steuerberater

Bremen

Oetje + Schierenbeck Steuerberater

Bremen

-

BSKP Dr. Broll Schmitt Kaufmann & Partner

Dresden

BSKP Dr. Broll Schmitt Kaufmann & Partner

Dresden

-

Beratungskanzlei Thorsten Hans Steuerberater

Hattingen

Beratungskanzlei Thorsten Hans Steuerberater

Hattingen

-

Weber - Krapp & Kollegen StBG mbH

Brilon

Weber - Krapp & Kollegen StBG mbH

Brilon

)

)

)

.png?h=64&w=200&mode=max&scale=canvas&format=webp&autorotate=true)

.png)